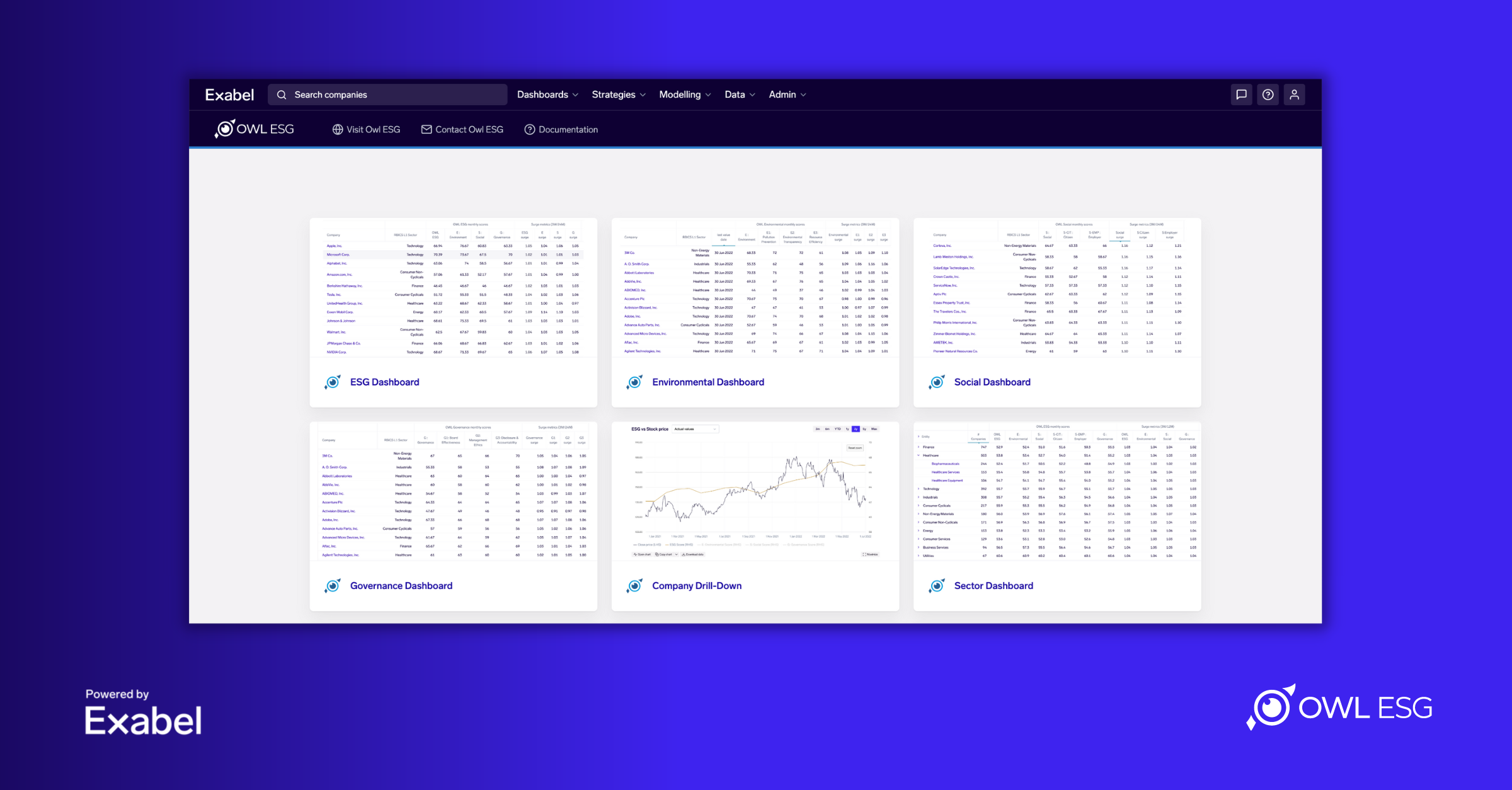

Exabel, the leading global fintech providing investors with a platform to make the most out of alternative data within their investment processes, has today announced a partnership with innovative ESG data provider OWL ESG. The powerful new insights capability of the OWL ESG Insights Platform will provide hedge funds and asset managers with curated insights based on OWL ESG’s data. Users will benefit from easy to navigate dashboards, visualizations, and KPI monitoring capabilities, which will help the idea-generation process by flagging trend shifts in OWL ESG’s datasets.

OWL ESG’s sustainable investing solutions consist of combining Environmental, Social and Governance expertise, data science, and cutting-edge technology to provide the data and analytics investors and corporate issuers need to achieve sustainability goals and ESG mandates.

The OWL ESG Insights Platform is part of Exabel’s growing partnership programme, in which data vendors can use the platform to discover valuable insights in their datasets, demonstrate that value to prospective customers, and deliver a new Insights product that is attractive to a broad audience of financial buyers. The Exabel partnership means OWL ESG’s clients are now able to more easily connect the dots between data and investable insight in a less expensive and time-consuming manner. Joining forces with Exabel provides alternative data vendors with a value-added presentation and monitoring layer and is powered by Exabel’s market leading Al analytics, financial modeling, and data science platform.

Commenting on the partnership, Neil Chapman, Exabel CEO, said: “We are delighted to be partnering with OWL ESG, an innovative provider of ESG data for the asset management industry. It is widely recognized that an investor in 2023 must be taking ESG issues into account as part of their investment strategy, and OWL provides a powerful set of tools to assist in that ambition.

“The use of data, including alternative data, in financial markets is vital. Modeling data in-house has become a prohibitive burden in time and cost, and we are on a mission to change that. Exabel’s SaaS delivered platform enables discretionary managers to complement their fundamental strategies with more data-driven techniques. It is the missing piece that allows asset managers to benefit from alternative data immediately.

“We are looking forward to working with OWL ESG to create actionable insights on its ESG data. Dashboards, intelligent screening and company drill down tools are just some of the features the platform can generate – all via an easy-to-use cloud interface.”

Ben Webster, CEO of OWL ESG, commented: “At OWL ESG, we’re proud of the ESG data we provide. Whether it is the smoothing effect created by our Consensus Scores, or our OWL eyeQ Data giving the market the most accurate, freshest, most objective, and most transparent ESG data available, at OWL we consistently provide the gold standard in ESG data.

“Now, to have the opportunity to work with a company like Exabel, putting our data into their software, I could not be more excited at the possibilities. For a market that has been begging for reliable, objective ESG data, we are serving that up, always piping hot, and using it to power this exceptional software overlay from Exabel.

“With the wide scope of capabilities Exabel offers, and the reliability of OWL’s data, the entire market – investors, wealth managers, businesses, consultants, and anyone else interested in how ESG is being addressed in corporate America and the world – is now able to explore ESG trends and changes in detail, perform complex analysis, and trust the results as accurate and objective.”