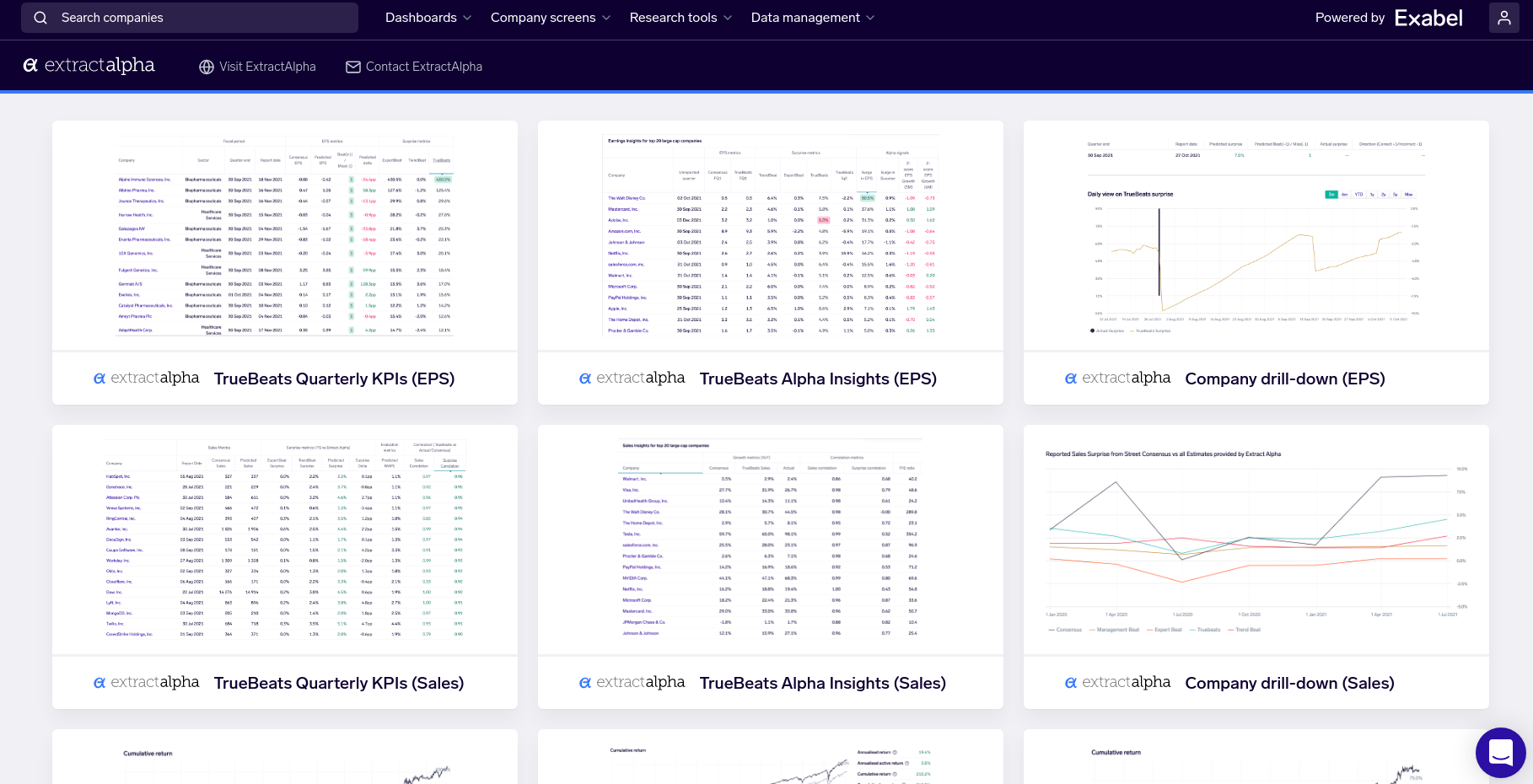

Exabel, a data and analytics platform for investment teams, is partnering with ExtractAlpha to deliver a powerful new insights platform for ExtractAlpha’s investment clients. The ExtractAlpha Intelligence Engine will give portfolio managers and hedge funds additional insights based on ExtractAlpha’s diverse alpha signals. The platform delivers user-friendly dashboards, visualizations and KPI monitoring capabilities, with a focus on TrueBeats – ExtractAlpha’s advanced earnings and sales surprise forecasting model. This assists investors in idea generation and fundamental analysis by spotting trend shifts in ExtractAlpha’s data. Partnering with Exabel gives alternative data vendors a compelling extra presentation and monitoring layer that investors value, utilising Exabel’s unique Al analytics, financial modelling and data science platform.

The ExtractAlpha Intelligence Engine forms part of Exabel’s growing partnership program. The platform empowers data vendors to discover new value-added insights in their datasets, demonstrate extra value to potential customers in easy-to-create report cards, and deliver a new, proven Insights product that appeals to a wide group of professional investors. Through the partnership with Exabel, ExtractAlpha’s clients can now much more easily and quickly identify alpha generating investment opportunities from its TruBeats revenue and EPS predictions.

ExtractAlpha is an independent research firm dedicated to providing unique, actionable alpha signals and datasets to institutional investors. ExtractAlpha’s rigorously researched quantitative products are designed for institutional investors to gain a measurable edge over their competitors and profit from these unique new sources of information.

Neil Chapman, CEO of Exabel commented: “We are delighted to be partnering with ExtractAlpha on this new insights platform. ExtractAlpha are well established in the alternative data world and their team’s magpie-like eye for value in a dataset has led to them accumulating an impressive portfolio of signals. We are proud to be able to help present these signals to ExtractAlpha’s clients in their best possible light.

ExtractAlpha are well established in the alternative data world and their team’s magpie-like eye for value in a dataset has led to them accumulating an impressive portfolio of signals.

“Today most investors want to use alternative data, but many find the cost and complexity of modeling data in-house a prohibitive burden. Exabel allows active managers to benefit from alternative data immediately to supplement fundamental strategies.

“We are looking forward to working with ExtractAlpha to create actionable insights on its data. Dashboards, intelligent screening of KPI predictions and company drill down tools are among the many features our easy to use SaaS platform can deliver.”

Vinesh Jha, CEO of ExtractAlpha commented:

“Today’s institutional investors are inundated with interesting-sounding datasets, but the vast majority of these datasets do not have true predictive power and the data delivery is often not designed with the end user in mind. We are excited to work with Exabel on addressing this issue by delivering our consistently profitable, predictive analytics via Exabel’s intuitive, user-focused, and feature-rich platform.

We are excited to work with Exabel on addressing this issue by delivering our consistently profitable, predictive analytics via Exabel’s intuitive, user-focused, and feature-rich platform.

This collaboration will allow discretionary managers access to the same powerful insights which our quant clients have been leveraging for years – including the most accurate earnings prediction model available on the market – in a way which is designed for their individual workflow.”

About Exabel

Exabel is an analytics platform for any investment professional who wants to benefit from alternative data and modern data science tools in their investment process. It fulfils a growing need in financial markets: while use of data – including fundamental, market, proprietary and alternative data – is critical for asset managers, modelling such data in house has become an excessive use of time and resources for all but the very largest investment firms. Exabel’s SaaS-delivered platform enables discretionary managers to complement their fundamental strategies with more data-driven techniques. It is the missing piece that allows investment teams to benefit from alternative data immediately. Exabel is currently growing rapidly having raised $22.7m and increased the team to 25 employees with more hiring underway.

About ExtractAlpha

ExtractAlpha is a data provider and independent quantitative research firm based in Hong Kong and founded by Vinesh Jha, former head of quantitative research at StarMine and former proprietary trader at Morgan Stanley’s PDT group. ExtractAlpha’s carefully researched and designed datasets and stock selection signals include sentiment, web data, technical, NLP, and ESG datasets, as well as the world’s largest crowdsourced financial forecasts platform, Estimize. ExtractAlpha’s clients include many of the world’s most sophisticated systematic hedge funds, trading desks, asset managers, and asset owners.