June 2nd, 2023 update:

Capri Holdings released its earnings on the 31st of May. In line with our research, Capri noted weak performance from the wholesale division, with revenues declining by double-digits in the latter part of FY2023. Moreover, it also called out shrinking margins for the Michael Kors brand, which had been strongly indicated by our research and the Ascential data on the Exabel platform. Capri also explicitly called out the strength of its accessories business at Versace, reporting a growth rate of over 40%, a phenomenon we highlighted in our Capri Holdings use case.

Note: Capri Holdings Ltd. quarterly earnings report on May 31st.

As the leading source of information on the pricing trends of clothing retailers and manufacturers around the globe, Ascential is the best place to help analysts better understand trends in the industry and insights behind specific companies in the luxury sector.

In this example, we look at the strategic shifts in the channel strategy in conjunction with the pricing and discounting trends at Capri Holdings Ltd. (CPRI). Furthermore, we dive deeper into the brand level and examine the Versace brand’s performance in various categories.

CPRI’s key brands: Michael Kors, Versace, and Jimmy Choo, are all sold via both the direct-to-consumer route as well as through the wholesale route. During the last earnings call, CPRI’s management admitted that it was disappointed with its results and singled out its lackluster performance in the wholesale channel across its major brands as a significant contributor to the poor performance. As a result, the management team acknowledged the need to reset their operating expense structure in light of the poor wholesale performance. In light of these structural changes underway in CPRI’s channel strategy, we analyze the channel trends observed at CPRI in Q4 and supplement the analysis later by looking at the brand-specific trends for Versace and Michael Kors.

With Q3 results revealing disappointing performance in the wholesale channel, we commence our analysis by examining the latest channel trends. Using the Ascential data on the Exabel platform, we can do so with just a click by studying the channel distribution of new products launched in Q4 in both US and the UK.

Number of New Products by Channel – Capri Holding Ltd. (US)

Number of New Products by Channel – Capri Holdings Ltd. (UK)

As we can see from the graphs above, the percentage of new products launched in Q4 through the direct-to-consumer channel has increased significantly as compared to the previous quarter in both the US and the UK.

In order to figure out whether this shift is driven by a continuation of sub par performances of the wholesale channel, we focus on the discounting trends and inventory availability in both the US and the UK.

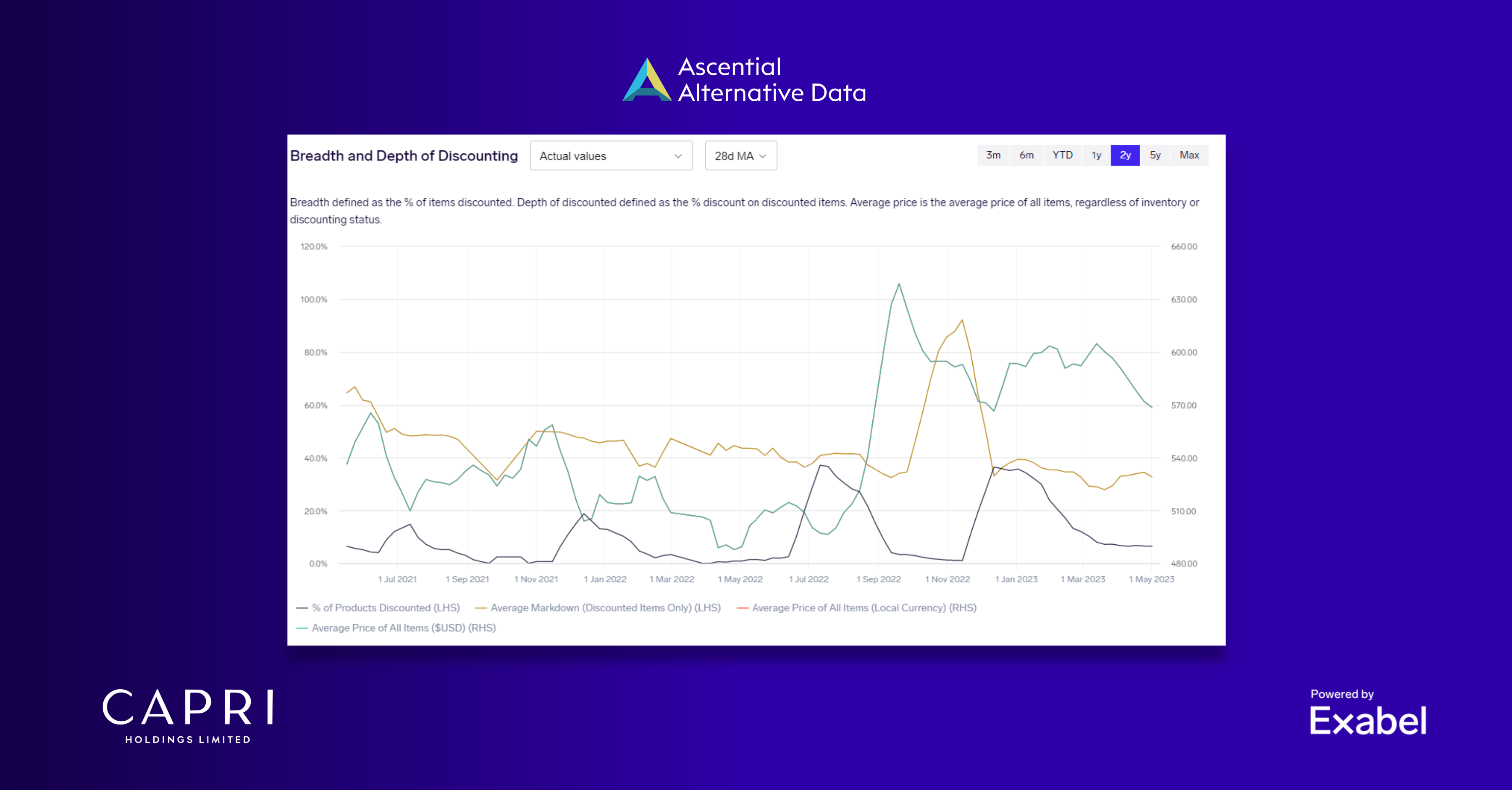

Depth of Discounting – Capri Holdings Ltd.(US)

Depth of Discounting – Capri Holdings Ltd. (UK)

Examining the discounting trends reveals that the depth of discounting in both the UK and USA in the wholesale channel has been significantly higher than that in the direct to consumer channel throughout Q4. In the light of the previous earnings call , where the management had noted its inability to sell through the wholesale platform, these elevated levels for depth of discounting might point towards a continued lack of drawing power of CPRI’s brands on the wholesale platform, which might have necessitated higher discounts just to clear inventory. In order to check this hypothesis we take a look inventory levels by channel across both countries.

Inventory Levels by Channel – Capri Holdings Ltd. (US)

Inventory Levels by Channel – Capri Holdings Ltd. (UK)

Upon examining the aforementioned graphs, it is evident that during FQ4 (Jan-March), despite deeper discounting in the wholesale channel, it is the inventory levels in the direct-to-consumer channel that have responded more favorably. In contrast, inventory levels in the wholesale channel have slightly increased from the beginning of the quarter, thereby supporting our hypothesis and suggesting that CPRI’s difficulties in the wholesale channel persist in Q4.

Although the channel analysis paints a bleak picture, there are still encouraging aspects for CPRI highlighted in the data. One such example is the success of Versace’s accessories business, which was acknowledged by the management in the last earnings call.Our data indicates that the strength of this category has carried forward to Q4. During Q4, accessories have gained share in terms of the number of SKU’s sold, while simultaneously increasing prices and reducing discounts on a year over year basis.

Discounting trends – Versace: Small Accessories

Despite the increasing prices and lower the discounts, the % of accessory SKUs in stock has gone down, indicating to its strength in attracting customers:

In Stock Percentages – Versace: Small Accessories

The above analysis indicated that although CPRI has had a few bright notes during FQ4 , such as its success in selling Versace branded accessories, it has struggled in attracting the customers through the wholesale route in both the US and the UK. As a result the inventory levels in the wholesale channel remain high, despite increases in the depth of discounting. Although this is ameliorated to some extent by its ability to charge higher prices through the DTC route, and strong performance in some categories, it seems reasonable to expect the gross margins at CPRI to continue to remain low for now.

About the dataset

The Ascential dataset is a curated offering of pricing and promotion insights for equity analysts and portfolio managers. Through meticulously scraping information on over 35 billion records collected over the past nine years, Ascential provides a unique view into corporate pricing strategies, discounting levels, and even wholesaler/retailer dynamics.

Hosted on the Exabel platform, a proven alternative data investment research platform used by many of the world’s leading investment teams to make better, data driven investment decisions. As Ascential is retained by retailers to obtain this data, there is significantly lower compliance risk – notably, the company has never received a cease and desist from a retailer. Ascential has become the industry-leading source of pricing and promotion insights for retailers and financial professionals alike.