The current inflationary climate in the U.S. is a double-edged sword for the US Quick Service Restaurant (QSR) industry. Fast food chains are facing rising costs for labor and ingredients, which are pressuring them to raise prices, but simultaneously inflation also is driving consumers to seek cheaper meals.

Using 90 West’s consumer spending data, users can more effectively utilize debit card transaction data within their investment research. In this example, we examine current key trends in the US QSR sector driven by the changes in consumer spending trends.

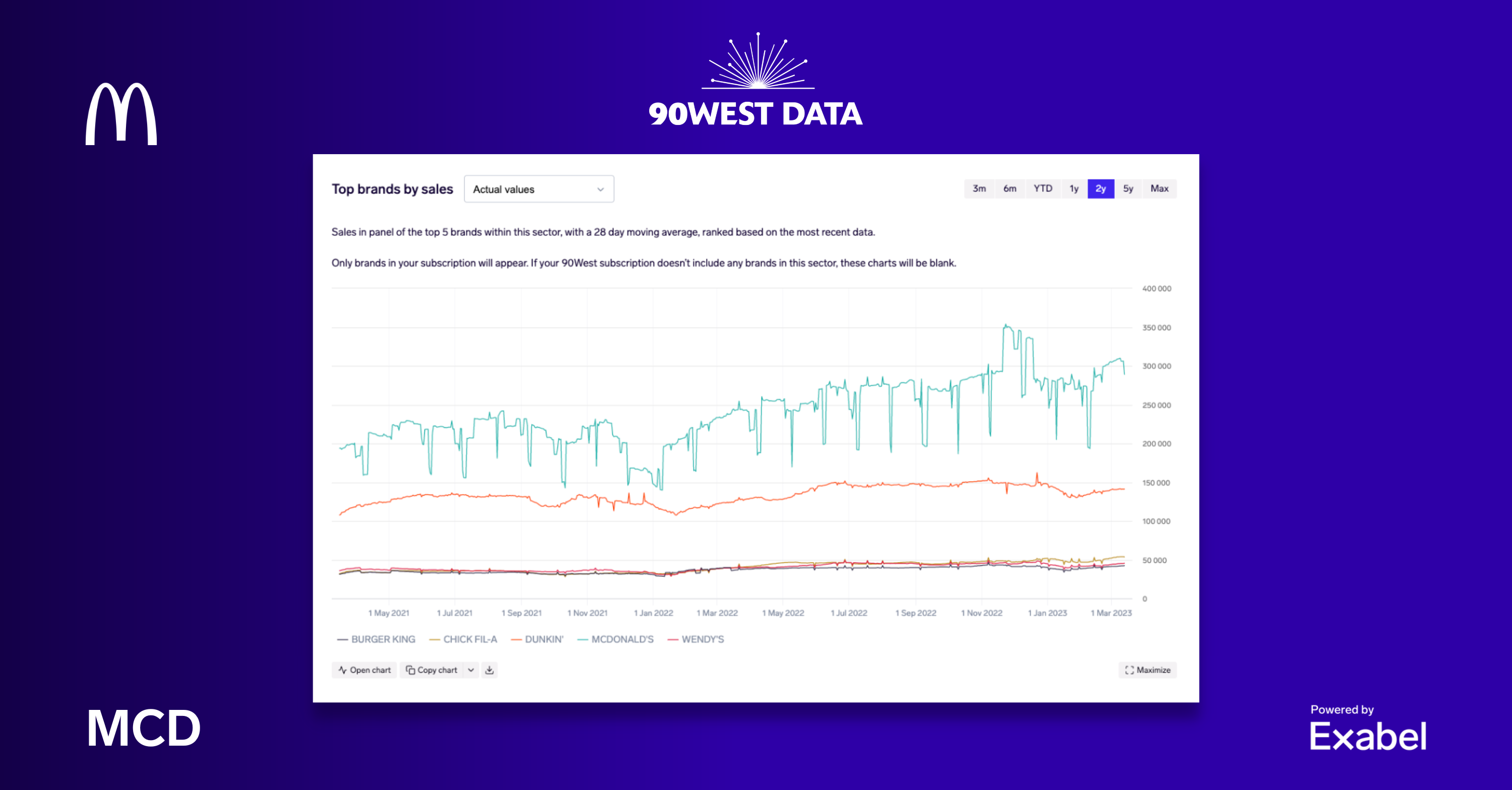

When examining recent changes observed in the market share among the most prominent brands in the QSR sector, it is clear how these dynamics have influenced the average ticket price. In order to discover these insights, it is important to begin with an overview of the QSR sector as a whole. On initial analysis, it’s apparent that McDonald’s has been the undisputed leader in the US market share, followed by Dunkin’, Chik Fil-A, Wendy’s, and, Burger King, respectively, as shown in Figure 1.

In addition to leading the raw market share in the QSR sector, Figure 2 also shows that over the last month, McDonald’s has also been the most significant share gainer in the sector; increasing its market share by 110bps when compared to the last year.

This research proposes the question: What is the driving force behind the share gains at McDonald’s?

Analysts and portfolio managers can use the 90 West’s data to reach these answers simply and quickly, navigating into the brand overview by clicking on any brand name in the Insights platform.

The depth of the data available on the brand drill-down provides the ability to attribute share growth to the different aspects of the business. Analyzing the transaction insights widget within the platform, users can see that whilst the average transaction value has increased substantially throughout the current quarter, the transaction frequency has remained relatively flat.

Further analysis across the consumer and transaction widgets indicates that McDonald’s has managed to increase its average ticket price without decreasing the number of transactions or unique customers.

By using 90 West’s Consumer Spending Insights platform, powered by Exabel, portfolio managers and analysts can enhance their investment research, with coverage of over 200 brands and 75 publicly traded companies, months ahead of company filings.

General disclaimer

This document is provided by Exabel AS. It is for information purposes only. It is not an invitation or inducement to engage in any investment activity and it does not contain investment advice. The information in this document shall not be relied on in making any investment decision or in connection with any contract or otherwise. Exabel AS makes no representation regarding, and accepts no liability or duty of care for, the accuracy, completeness or timeliness of the information in this document or its fitness for any particular purpose or use