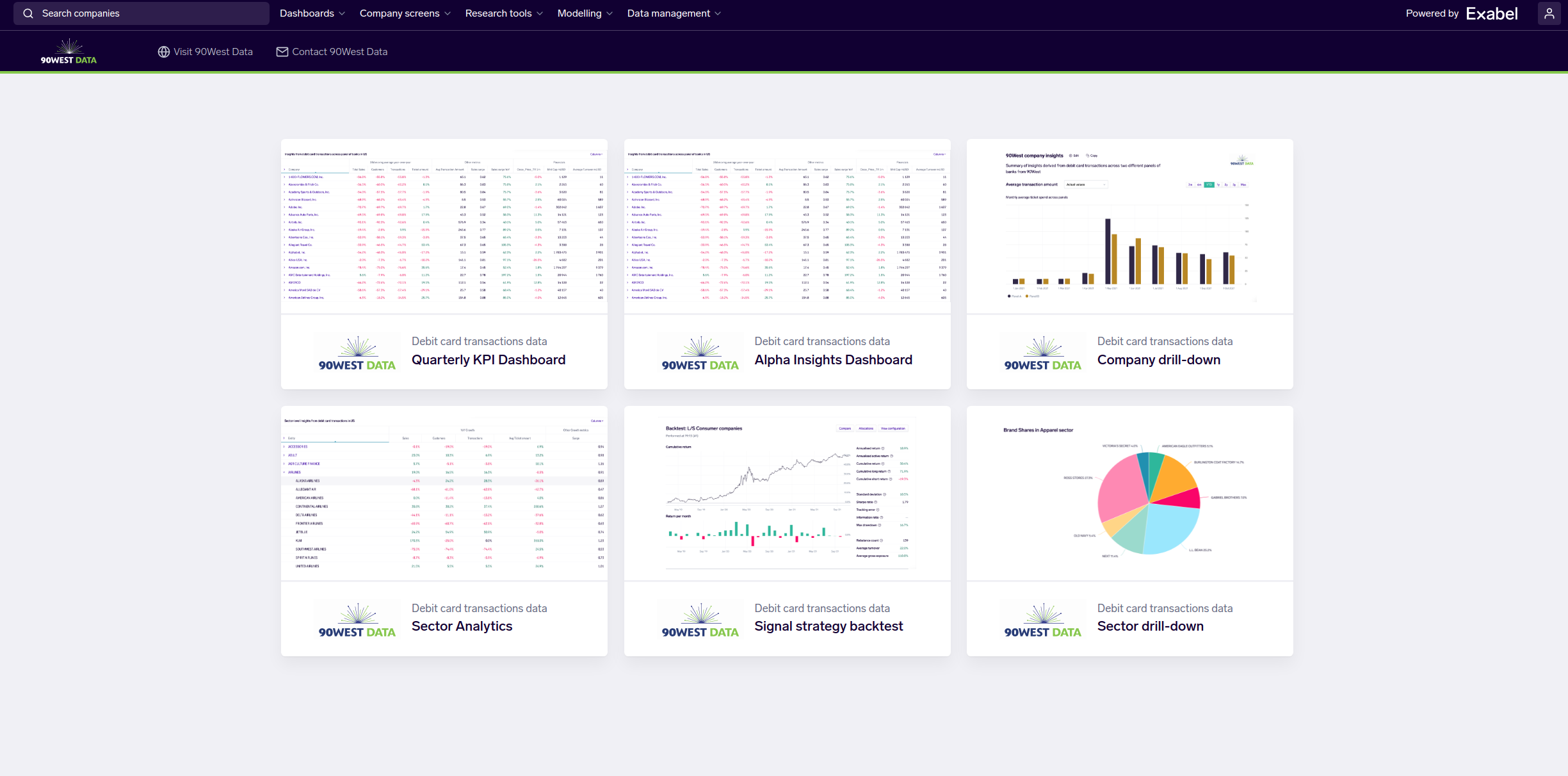

90 West, the leading provider of a unique consumer transactions dataset covering the entire United States market, with a particular concentration on the midwest region, is pleased to announce a partnership with Exabel which will result in the creation of a new insights platform for 90 West’s investment clients. The 90 West Insights Platform will give portfolio managers and hedge funds additional insights based on 90 West’s unique panel of consumer transaction data, which track the pricing and performance trends across a broad range of companies. The platform delivers user-friendly dashboards, visualizations and KPI monitoring capabilities. This assists investors in idea generation by spotting trend shifts in 90 West’s consumer data. Partnering with Exabel gives alt data vendors a compelling extra presentation and monitoring layer that investors value, utilising Exabel’s unique Al analytics, financial modelling and data science platform.

The 90 West Insights Platform forms part of Exabel’s growing partnership program. The platform empowers data vendors to discover new value-added insights in their datasets, demonstrate extra value to potential customers in easy-to-create report cards, and deliver a new, proven Insights product that appeals to a wide group of professional investors. Through the partnership with Exabel, 90 West’s clients can now much more easily and quickly leverage raw alt data to exploit investable insights.

“Our partnership with Exabel is a huge step towards simplifying the evaluation of, and subsequent engagement with 90 West’s data offering.”

John Farrall of 90 West commented: “90 West is excited to partner with Exabel. Leveraging Exabel’s intuitive data visualization platform, clients and prospective clients can easily drill down on specific sectors or stocks, flagging outliers and inflection points. Our partnership with Exabel is a huge step towards simplifying the evaluation of, and subsequent engagement with 90 West’s data offering.”

Neil Chapman, CEO of Exabel commented: “Making the most of alternative data is all about combining complementary data sources, which is why we are so excited to be partnering with 90 West. 90 West’s unique consumer transactions panel sits very well alongside the powerful transactions data already available via Exabel’s market offering, and we believe investors will be able to extract huge value from it. The uniqueness of 90 West’s dataset also makes it immensely compelling for investment teams to use on its own, and we are glad that Exabel’s software will be able to empower 90 West’s clients even further.”

“90 West’s unique consumer transactions panel sits very well alongside the powerful transactions data already available via Exabel’s market offering, and we believe investors will be able to extract huge value from it.”

“Today most investors want to use alternative data, but many find the cost and complexity of modelling data in-house a prohibitive burden. Exabel allows active managers to benefit from alternative data immediately to supplement fundamental strategies.”

“We are looking forward to working with 90 West to create actionable insights on its data. Dashboards, intelligent screening KPI prediction models and company drill down tools are among the many features our easy to use SaaS platform can deliver.”

About 90 West

90 West Data engages decision makers with data and insights into retail merchants or consumer service providers. 90 West sells data, reports, analysis, and services based on its unique panel of US consumer transaction data. 90 West develops unique customer insights through advanced merchant tagging, categorization, and contextualization. Data is collected and analyzed daily. Insights include merchant level transaction trends and demographic information about the population including age and location.

About Exabel

Exabel is an analytics platform for any investment professional who wants to benefit from alternative data and modern data science tools in their investment process. It fulfils a growing need in financial markets: while use of data – including fundamental, market, proprietary and alternative data – is critical for asset managers, modelling such data in house has become an excessive use of time and resources for all but the very largest investment firms. Exabel’s SaaS-delivered platform enables discretionary managers to complement their fundamental strategies with more data-driven techniques. It is the missing piece that allows investment teams to benefit from alternative data immediately. Exabel is currently growing rapidly having raised $22.7m and increased the team to 35 employees with more hiring underway.