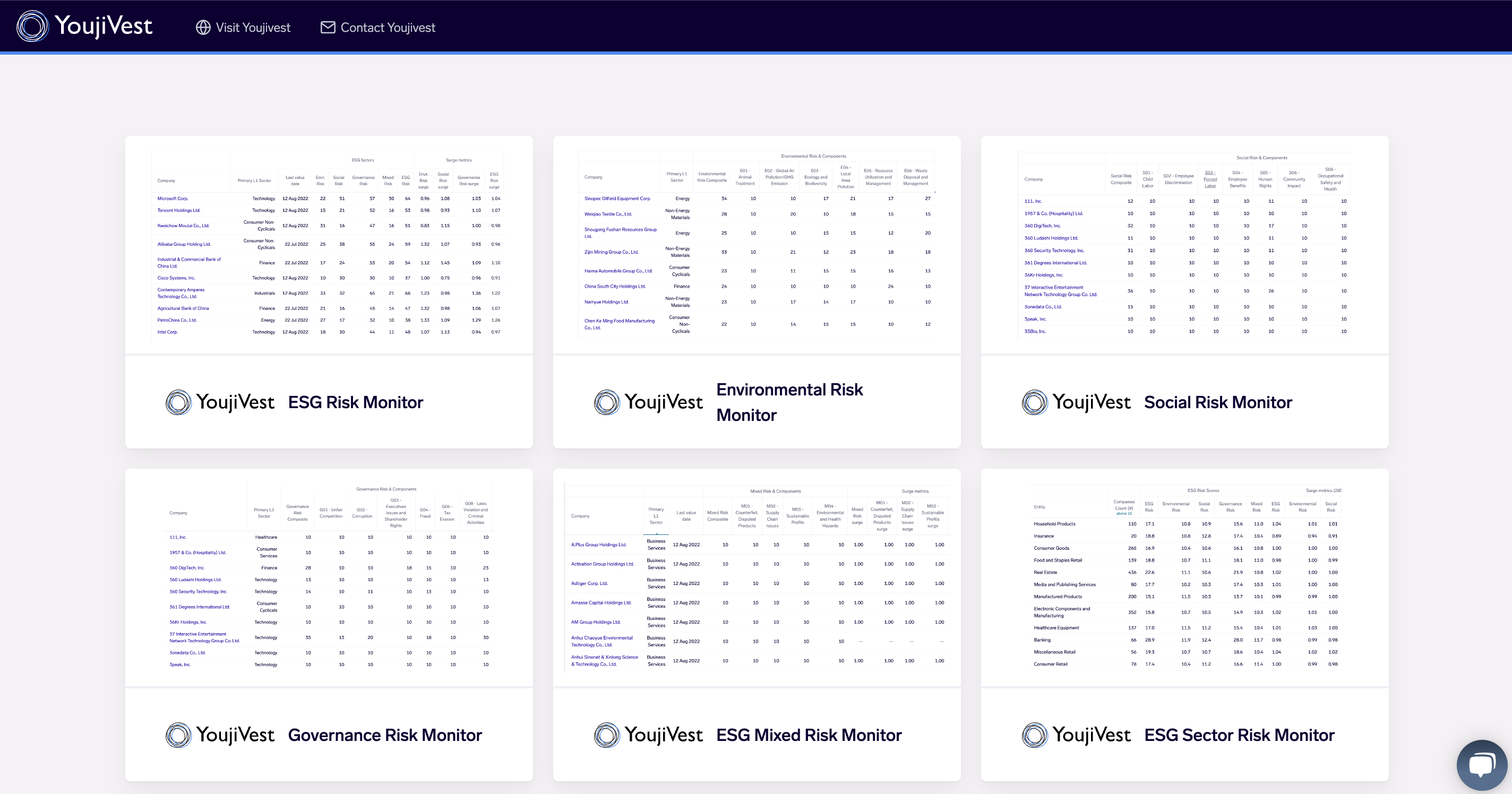

Exabel, the data and analytics platform for investment teams, has today announced its partnership with Youjivest to deliver a powerful new insights capability for YoujiVest investment clients. The YoujiVest Insights Platform will provide asset managers, asset owners and hedge funds with curated insights based on YoujiVest’s ESG data focusing on Chinese securities. This offering will provide users with easy to navigate dashboards, analytics, visualizations and KPI monitoring capabilities to help enhance the integration of ESG and sustainable considerations into their investment process and workflow.

Joining forces with Exabel provides alternative data vendors with a value-added presentation and monitoring layer and is powered by Exabel’s market leading Al analytics, financial modelling and data science platform. The YoujiVest Insights Platform is part of Exabel’s growing partnership program, in which data vendors can use the platform to discover valuable insights in their datasets, demonstrate that value to prospective customers, and deliver a new Insights product that is attractive to a broad audience of financial buyers.

In partnering with Exabel, YoujiVest’s clients are now able to more easily connect the dots in a time efficient and cost-effective manner between data and investment insights.

Commenting on the partnership, Neil Chapman, Exabel CEO said: “We are delighted to be partnering with YoujiVest, one of the premier providers of ESG data on the Chinese market. YoujiVest combines two areas of massive market interest, ESG and China, and we are thrilled to get the chance to help bring these insights to a wider audience.”

The use of data, including alternative data, in financial markets is vital. Modelling data in-house has become a prohibitive burden in time and cost, and Exabel is on a mission to change that. Exabel’s SaaS delivered platform enables discretionary managers to complement their fundamental strategies with more data-driven techniques. It is the missing piece that allows asset managers to benefit from alternative data immediately.

“We are delighted to be partnering with Exabel to bring forth this data platform enhancement to our clients and the ESG marketplace. With all the built-in features connecting our data with practical analytic applications, users are now equipped with the tools to extract ESG insights impacting their investment with ease, efficiency and confidence.”

“We are looking forward to working with YoujiVest to create actionable insights on its data. Dashboards, intelligent screening and company drill down tools are just some of the features the platform can generate – all via an easy-to-use cloud interface.”

Vivi Hu, CEO YoujiVest, commented: “We are delighted to be partnering with Exabel to bring forth this data platform enhancement to our clients and the ESG marketplace. With all the built-in features connecting our data with practical analytic applications, users are now equipped with the tools to extract ESG insights impacting their investment with ease, efficiency and confidence.”

About Exabel

Exabel is an analytics platform for any investment professional who wants to benefit from alternative data and modern data science tools in their investment process. It fulfils a growing need in financial markets: while use of data – including fundamental, market, proprietary and alternative data -is critical for asset managers, modelling such data in house has become an excessive use of time and resources for all but the very largest investment firms. Exabel’s SaaS-delivered platform enables discretionary managers to complement their fundamental strategies with more data-driven techniques. It is the missing piece that allows investment teams to benefit from alternative data immediately. Exabel is currently growing rapidly having raised $22.7m and increased the team to 40 employees with more hiring underway.

About YoujiVest

YoujiVest is a premier ESG data and analytics firm trusted by the world’s leading asset managers and institutional investors to support the irresponsible investments in Chinese securities. As a pioneer specializing in the development of China-native and ESG-native solutions, YoujiVest offers the most comprehensive data coverage of China A-shares, Hong Kong listed stocks andChinese ADRs exceeding 8000 securities. Our engineers, data scientists, and quant practitioners leverage the latest cutting-edge AI technologies and investment research to develop a suite of high signal-to-noise sustainability information solutions, covering the areas of ESG Risks, Carbon and GHGEmissions, and other Hazardous Environmental Pollutants. Founded by a team of fintech industry veterans, YoujiVest is based in Hong Kong with offices in Beijing,Shanghai, and New York.