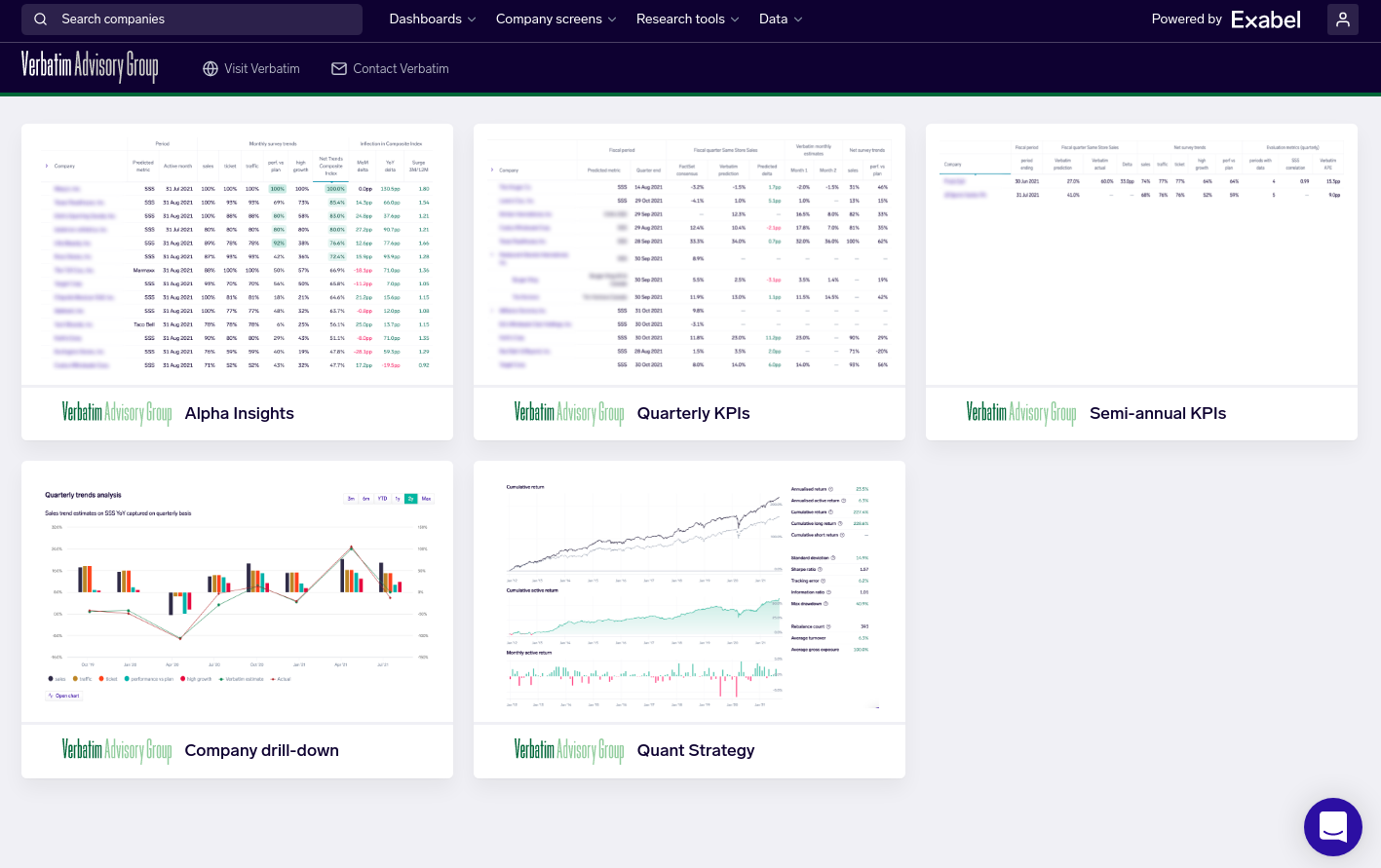

Exabel, a data and analytics platform for investment teams, is partnering with Verbatim Advisory Group to deliver a powerful new insights platform for Verbatim’s investment clients. The Verbatim Data Insights Platform will give portfolio managers and analysts additional insights based on Verbatim’s channel survey data, which tracks the demand and performance trends across a broad range of retailers and restaurants. The platform delivers user-friendly dashboards, visualizations and KPI monitoring capabilities. This assists investors in idea generation by spotting trend shifts in Verbatim’s consumer data. Partnering with Exabel gives alternative data vendors a compelling presentation and monitoring layer that investors value, utilising Exabel’s unique Al analytics, financial modeling and data science platform.

The Verbatim Insights Platform forms part of Exabel’s growing partnership program. The platform empowers data vendors to discover new value-added insights in their datasets, demonstrate extra value to potential customers in easy-to-create report cards, and deliver a new, proven Insights product that appeals to a wide group of professional investors. Through the partnership with Exabel, it will be easier and faster for Verbatim’s clients to leverage alternative data to exploit investable insights.

Verbatim Advisory Group has been providing quantitative and qualitative data from its surveys since 2005, adding conviction to signals with insights on both long-term company initiatives and near-term impacts on the business. Clients are long-only, long-short, and more recently quant-focused investors.

Neil Chapman, CEO of Exabel commented: “Verbatim is a well-established provider of extremely valuable channel survey data, and we’re thrilled to be partnering to provide additional actionable insights to their clients. As alternative data has moved into the mainstream, data like Verbatim’s reminds us that there is still huge value to be found in survey techniques that have been honed and perfected over decades. We at Exabel are excited to work with providers of the full gamut of data types, believing that this provides investors with the most complete set of tools with which to extract alpha from the market.

“As alternative data has moved into the mainstream, data like Verbatim’s reminds us that there is still huge value to be found in survey techniques that have been honed and perfected over decades.”

“Today most investors want to use alternative data, but many find the cost and complexity of modeling data in-house a prohibitive burden. Exabel allows active managers to benefit from alternative data immediately to supplement fundamental strategies.

“We are looking forward to working with Verbatim to create actionable insights on its data. Dashboards, intelligent screening KPI prediction models and company drill down tools are among the many features our easy to use SaaS platform can deliver.”

John Strehle, Managing Partner at Verbatim Advisory Group commented: “As data proliferation stretches the standard backtest from days to months, we’re excited to see that Exabel cuts these initial evaluation periods by 90%. With Exabel’s intuitive data visualizations, our prospects can drill down on a specific ticker within minutes and are introduced to pre-built investment strategies on the whole data set.

“As data proliferation stretches the standard backtest from days to months, we’re excited to see that Exabel cuts these initial evaluation periods by 90%.”

“Our existing clients now have the option of an Exabel dashboard that flags outliers and inflections across our coverage universe so they can make better use of their time with Verbatim’s corresponding ticker-specific research reports. Furthermore, we’re excited at the prospect of clients using Exabel’s tools to combine Verbatim with their other data sources to create consolidated dashboards and ensemble models”.

About Exabel

Exabel is an analytics platform for any investment professional who wants to benefit from alternative data and modern data science tools in their investment process. It fulfils a growing need in financial markets: while use of data – including fundamental, market, proprietary and alternative data – is critical for asset managers, modeling such data in house has become an excessive use of time and resources for all but the very largest investment firms. Exabel’s SaaS-delivered platform enables discretionary managers to complement their fundamental strategies with more data-driven techniques. It is the missing piece that allows investment teams to benefit from alternative data immediately. Exabel is currently growing rapidly having raised $22.7m and increased the team to 25 employees with more hiring underway.

About Verbatim Advisory Group

Verbatim Advisory Group is an alternative research firm serving institutional investors. The company’s quantamental approach to channel surveys delivers unique and proprietary insights from a global dataset. The company’s primary research spans Business Services, Consumer Products & Services, Retail & Restaurants, Healthcare, Industrials & Energy, and TMT.