Exabel, the data and analytics platform for investment teams, today announced its partnership with New Constructs, an independent investment research and financial data firm, to deliver powerful analytical capabilities via the New Constructs Earnings Distortion Insights Platform.

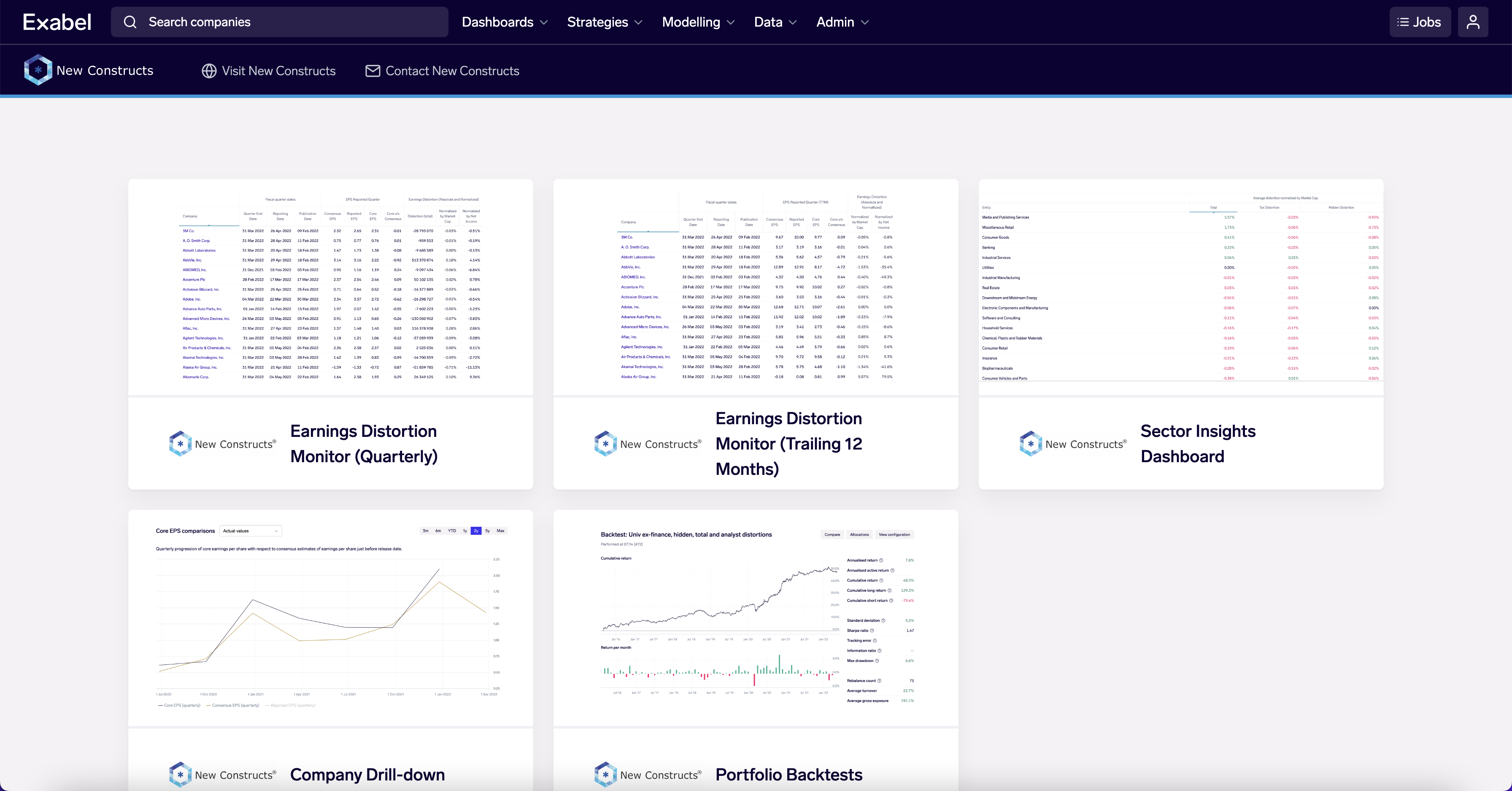

This new offering gives hedge funds and asset managers easy-to-navigate dashboards, visualizations and curated KPI monitoring capabilities to aid in the idea generation process by flagging trends and changes in New Constructs’ proprietary Earnings Distortion data. New Constructs technology uses artificial intelligence to analyze corporate financial filings, especially the footnotes, to deliver proven-superior earnings, estimates, financial research and investment ratings.

The New Constructs Earnings Distortion Insights Platform is part of Exabel’s growing partnership program, that enables data vendors to discover valuable insights in their datasets, demonstrate that value to prospective customers, and deliver a new Insights product that is attractive to a broad audience of financial buyers. In partnering with Exabel, New Constructs’ clients are now able to more easily and inexpensively monetize the novel alpha in Earnings Distortion.

Neil Chapman, CEO of Exabel, commented: “We are very pleased to have this opportunity to collaborate with New Constructs and help further empower asset managers to get alpha from Earnings Distortion data. Financial footnotes have been proven to contain vast amounts of valuable information, and the New Constructs Earnings Distortion Insights Platform will make this value easier for New Constructs’ clients to uncover.

“Financial footnotes have been proven to contain vast amounts of valuable information, and the New Constructs Earnings Distortion Insights Platform will make this value easier for New Constructs’ clients to uncover.”

“The use of data, including alternative data, in financial markets is vital. Modeling data in-house has become a prohibitive burden in time and cost, and we are on a mission to change that. Exabel’s SaaS delivered platform enables discretionary managers to complement their fundamental strategies with more data-driven techniques. It is the missing piece that allows asset managers to benefit from alternative data immediately.”

“We are very excited to be working with Exabel to extend the accessibility of our proprietary data and insights,” said David Trainer, CEO of New Constructs.

“The market volatility of 2022 is a reminder that the stock market isn’t a game and due diligence matters. We are proud to provide investors with the tools they need to adeptly navigate choppy markets.”

“We are experiencing a very precarious stock market environment, and investors need access to the highest quality data and investment research now more than ever. The market volatility of 2022 is a reminder that the stock market isn’t a game and due diligence matters. We are proud to provide investors with the tools they need to adeptly navigate choppy markets.”

About Exabel

Exabel is an analytics platform for any investment professional who wants to benefit from alternative data and modern data science tools in their investment process. It fulfills a growing need in financial markets: while use of data – including fundamental, market, proprietary and alternative data – is critical for asset managers, modeling such data in house has become an excessive use of time and resources for all but the very largest investment firms. Exabel’s SaaS-delivered platform enables discretionary managers to complement their fundamental strategies with more data-driven techniques. It is the missing piece that allows investment teams to benefit from alternative data immediately. Exabel is currently growing rapidly having raised $22.7m and increased the team to 40 employees with more hiring underway.

About New Constructs

New Constructs provides proprietary insights into the fundamentals and valuation of private and public businesses based on superior fundamental data and research. The firm specializes in analyzing footnotes in hundreds of thousands of corporate financial filings and revealing critical details that drive uniquely comprehensive and independent debt and equity investment ratings, valuation models, and research tools. National publications including CNBC, The Wall Street Journal, Barron’s, Forbes, Seeking Alpha, Benzinga, and more regularly feature New Constructs’ research. Partnerships with IEX Cloud, Apex Clearing, TD Ameritrade, Wisdom Tree, Refinitiv/Thomson Reuters, Interactive Brokers, and EY enable New Constructs to deliver superior financial analytics, especially Core Earnings and Earnings Distortion to millions of investors, financial advisors, and corporate executives. New Constructs was founded in 2002 by veteran Wall Street analyst David Trainer.