September 18th, 2023

Analyzing H2 pricing, promotion, and availability versus ASOS

Introduction

ASOS has shown superior performance to Boohoo during the unreported period ended August 31, 2023, with regard to meaningfully improving sell-through with relatively less promotional activity and higher prices. This analysis aims to substantiate this claim by leveraging Ascential Alternative Data’s eCommerce Insights Platform, offering a deep dive into both retailers’ pricing, promotional, availability, and new product launch metrics obtained from website scrapes. To provide a holistic view, the focus spans both their primary market, the UK, and their burgeoning market in the US. In each geographic sector, this paper will assess site-wide and namesake brand performance, ensuring a like-for-like comparison for an accurate representation of the two retailers’ trajectories.

Key Takeaways

Pricing and Promotional Activity

In the UK, Boohoo and ASOS both increased their average prices by roughly 12% and 11% respectively. However, Boohoo amplified its promotional activities with a 6.1% YoY increase in discount factor, significantly higher than ASOS’s 2.1%. In the US, while ASOS showed a consistent rise in its pricing, Boohoo experienced a decline by 3.3% YoY in H2 after a previous hike.

Inventory and Availability Insights

ASOS demonstrated better inventory turnover, with its out-of-stock SKUs in the UK rising by 13.4% YoY, suggesting a better alignment with demand. In contrast, Boohoo and Debenhams trailed behind with 8.3% and 8.4% respectively. In the US, ASOS continued to lead with a 9.1% YoY increase in out-of-stock SKUs, whereas Boohoo faced a 1.3% decline.

New Product Introductions

ASOS exhibited confidence in its inventory position with only a minor 1.6% YoY dip in new product introductions in the UK. Boohoo, on the other hand, showed a significant 10.7% YoY drop, indicating possible strategic challenges or misalignments.

Key Finding

ASOS appears to be strategically ahead of Boohoo, especially in the UK market. ASOS’s ability to improve sell-through without heavy reliance on promotions and its pricing strategy may place it in a better position than Boohoo’s aggressive price investments.

UK Market Analysis

All Products

Pricing and Promotion

The pricing data for the six months ending August 31, 2023, revealed Boohoo’s average prices in the UK increased by roughly 12% versus the same period last year, with ASOS not far behind at an 11% rise. Interestingly, Debenhams, under Boohoo’s umbrella, pushed further ahead with a notable 22% YoY price hike.

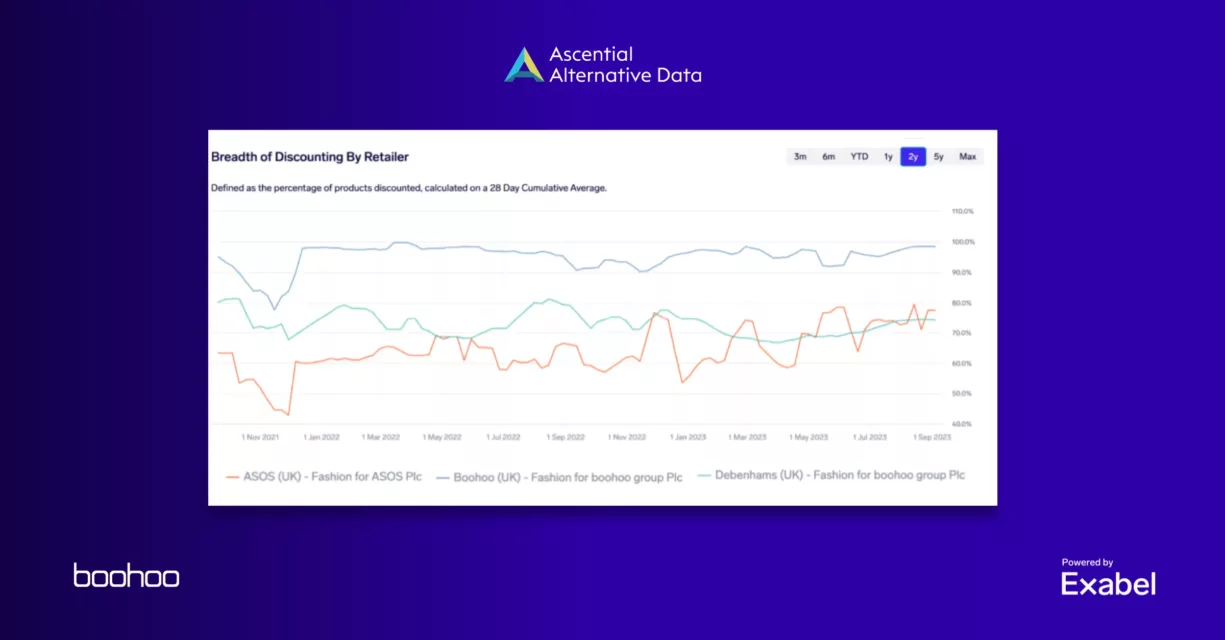

In the sphere of promotional activity, ASOS’s discount factor (the product of the breadth and depth of promotional activity) increased by 2.1% YoY in the UK. Boohoo amplified its promotional fervor, registering a 6.1% increase, the most substantial since H1 2019. Debenhams stood out with a mere 0.5% uptick, showcasing the least change in discounting among the three.

Diving deeper, the promotional nuances between ASOS and Boohoo emanate from differing strategies. ASOS expanded the breadth of discounted products.

Boohoo, however, ventured into steeper discounting, evident both at Boohoo and Debenhams, with some of the heaviest markdowns in five years for Boohoo.

Availability

Sell-through (the inverse of percent-SKUs-in-stock) is a crucial indicator of inventory positions, providing insight into the companies’ ability to turn inventory. For the period ended August 31, 2023, ASOS’s out-of-stock SKUs leap 13.4% YoY, signaling robust demand alignment. Boohoo, with 8.3%, and Debenhams, with 8.4%, trailed behind, reflecting a lesser efficiency relative to ASOS.

New Products

Adding another layer, the new product ratio analysis tips the scale toward ASOS.

We examine the proportion of new products to gauge confidence in the inventory position: generally, we see stable product launches when management is confident whereas large shifts can indicate strategic change and/or weakness. While ASOS experienced a 1.6% YoY dip, hinting at deliberate inventory streamlining, Boohoo displayed a significant 10.7% YoY drop, perhaps pointing to strategy misalignments or challenges. Debenhams, meanwhile, showed some signs of stabilization with a 7.1% decline, a recovery from its previous 13.3% slide.

Namesake Brand

Pricing and Promotion

Focusing on ASOS Design and Boohoo’s eponymous label, the scrape discerned distinct trajectories. While ASOS Design saw a 16.7% price increase, Boohoo advanced by a more modest 6.7%. Boohoo’s discount factor YoY increased by 7.0%, dwarfing ASOS Design’s 2.4%. The primary promotional divergence was steeper discounting for Boohoo brand products.

Availability

ASOS Design improved from 0.9% YoY increase last period to 12.9% YoY increase in out-of-stock SKUs. Boohoo improved even more, from negative 1.9% YoY to an increase of 17.6% YoY in the unreported period.

New Products

As for new product launches, ASOS Design remained relatively flat with only a 0.9% YoY dip, while Boohoo shrunk its new product proportion by 11.4%

US Market Analysis

All Products

Pricing and Promotion

Translating to the US arena, Boohoo and ASOS illustrated divergent pricing trends. Boohoo’s average prices, which had increased by 14% YoY in H1, declined by 3.3% YoY in the unreported period. ASOS, on the other hand, managed a 9.4% YoY increase for H2 after a previous 16.6% H1 rise.

In terms of promotional activity, Boohoo and ASOS remained relatively stable with a 0.7% and 1.4% YoY increase in discount factor, respectively. Although, ASOS’s sequential performance was a larger swing than Boohoo’s.

Availability

Sell-through dynamics favor ASOS’s 9.1% YoY increase in out-of-stock SKUs, starkly contrasting Boohoo’s 1.3% decline.

Namesake Brand

Pricing and Promotion

While ASOS Design’s pricing strategy boasted a 12.8% YoY rise, Boohoo’s counterpart dwindled by 3.4%. ASOS Design’s discount factor expanded by 3.2% YoY, while Boohoo remained modest at 0.7%.

Availability

ASOS Design saw a 9.4% YoY sell-through uplift, but Boohoo dipped by 1.5%, mirroring the overall trend of the retailers.

Caveats

While the data from web-scrapes of the primary retailer websites offers valuable insights into the promotional strategies of ASOS and Boohoo, it’s important to highlight some inherent limitations and blind spots in this analysis.

Alternative Sales Channels

Notably, there are other online platforms where these brands liquidate their inventory. For instance, in July, ASOS cleared a portion of their inventory on a separate URL, asossamplesale.com, which has been known to offer deeper discounts1. These alternative platforms can represent significant sales and discounting activities that our current dataset does not account for.

In-store Promotions

Our data only reflects online promotions. In-store promotions, which can differ significantly from online offerings, remain a blind spot in our analysis. Especially for brands with a considerable brick-and-mortar presence, in-store sales can be a significant component of their overall sales strategy.

Site-wide Promotions

The scraped data might not encapsulate site-wide promotions that are applied automatically at checkout or through the use of promotional codes. These types of discounts can considerably alter the effective price the customer pays, and thereby influence the perceived value and buying decision.

Temporal Limitations

Web scraping provides a snapshot of data at the point of extraction. This means we might miss short-lived promotions, flash sales, or rapid stock turnover, which can be essential components of a brand’s promotional strategy.

Regional Variations

The dataset is primarily focused on the US and UK markets. It does not account for promotional activities, pricing strategies, or stock availability in other key markets which can be significant, especially if brands are pursuing region-specific strategies.

Product Returns

Web scrape data doesn’t provide insight into product return rates. High return rates can negate the apparent success of a sell-through strategy.

Conclusion

Taken as a whole, the data suggests ASOS has displayed a more strategic and successful approach during H2, especially in its core UK market. ASOS’s ability to bolster its sell-through without excessively leaning on promotions, coupled with its product pricing, positions it ahead of Boohoo. Boohoo, despite its more aggressive promotional strategy, has not seen the same level of sell-through improvement. ASOS’s commitment to value may give it the upper hand over Boohoo’s investments in price.

References

1) https://www.just-style.com/news/asos-sample-sale-site-to-clear-excess-inventory-sparks-sustainability-debate/